When looking at several local economic factors, 2022 is starting off strong. We’re seeing strong demand for homes, job growth, and improving employment rates. Let’s review the positive growth we’ve seen in Bay Area real estate and explore what’s to come.

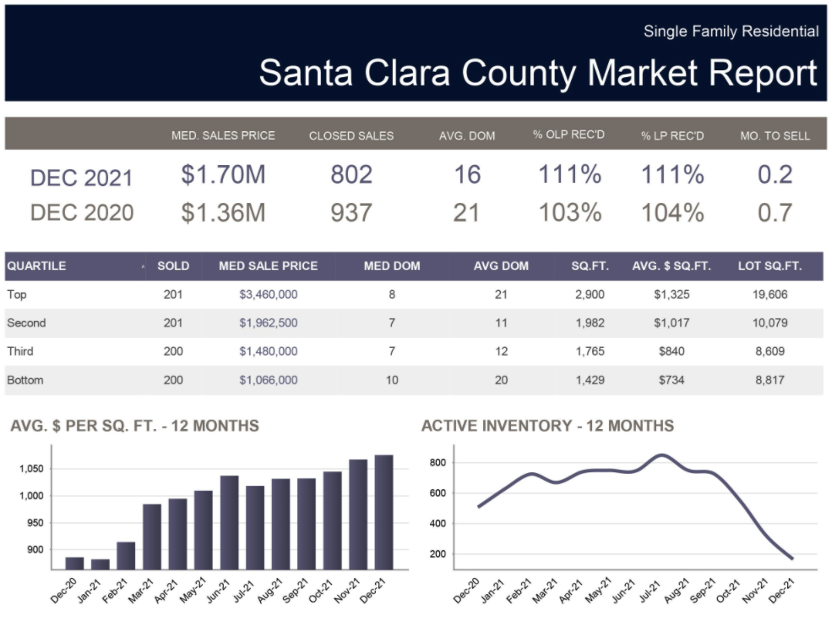

Santa Clara County 2021 Housing Performance

- Overall, the county marked an increase of $34,000 or 25% in the median single-family residence sales price. Important to note that it is a blended average for the county. It doesn’t illustrate the larger gains realized in specific neighborhoods.

- According to Dave Walsch, President of the California Realtor Association, closed home sales increased 34.8% as compared to 1.8% in 2020.

- To differentiate between starter homes and properties with larger square footage and lot size, the graph below includes the four quartiles of sold homes. The second quartile representing sold homes with an average 1,992 square feet and 10K lot sizes are closely approaching the $2 million milestone.

- It’s no surprise that many 2021 sales resulted in multiple offers. Comparing the percentage over list price from Dec 2020 to Dec 2021, we saw an increase from 104% to 111%.

- The days on market throughout 2021 remained below 25 days. However, March through November were 15 and under, which is further evidence of a hot seller’s market.

- For condos and townhomes, the numbers also show positive growth. The median sales price rose from $830K to $929K. More significantly, the number of months to sell dropped from 1.2 months to 0.3 months. Low inventory continues to fuel sales over asking prices.

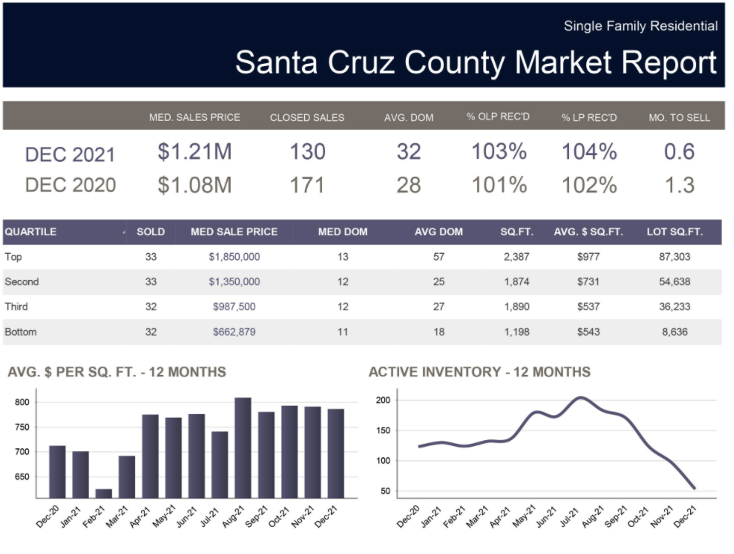

Santa Cruz County 2021 Housing Performance

- Overall, the county marked an increase of $13,000 or 12% in the median single-family residence sales price. Since these numbers represent a blended average for the county, it doesn’t illustrate the larger gains realized in some Santa Cruz areas.

- To differentiate between starter homes and properties with larger square footage and lot size, the graph below includes the four quartiles of sold homes. The second quartile, representing sold homes with an average 1,874 square feet and lot sizes over an acre, now have the median sale price of $1.35M.

- While at a lower rate than its neighbor Santa Clara County, the market showed actual sales price above listing. In 2021, the average sale received 104% over asking, compared to sales receiving 100% of asking price in December 2020.

- Median sale price, median list price, and average days on market fluctuated for most of 2021. After reaching an inventory peak in mid summer, the number of available homes for sales dropped significantly in the 4th quarter.

- For condos and townhomes, the numbers also show slow yet positive growth of 6%. The median sales price rose from $629K to $669K. More significantly, the number of months to sell dropped from 1.3 months to only 0.5 months. Low inventory continues to fuel sales over asking prices.

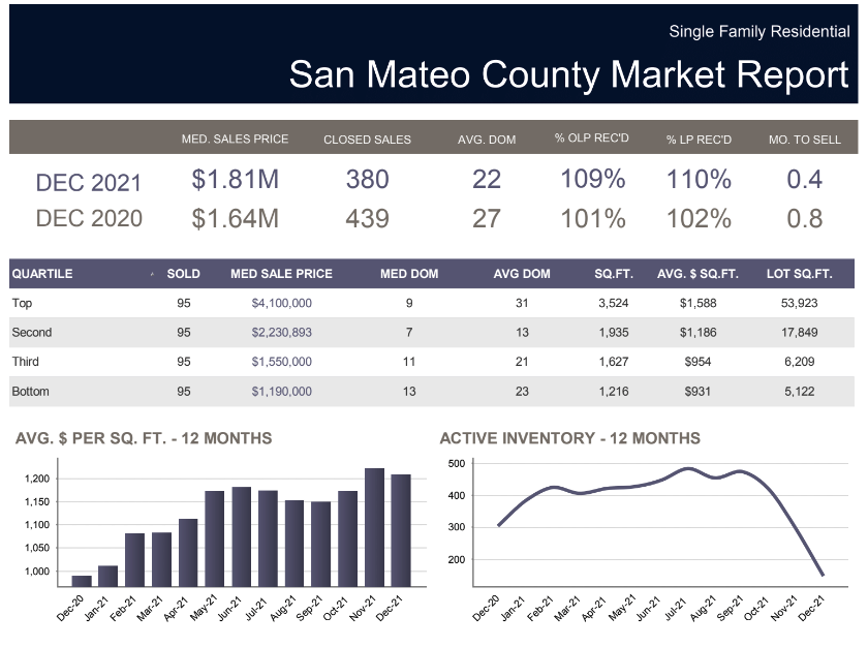

San Mateo County 2021 Housing Performance

- Overall, the Peninsula marked an increase of $17,000 or 10% in the median single-family residence sales price. Since these numbers represent a blended average for the county, it doesn’t illustrate the larger gains or sales prices realized in some San Mateo County cities such as Atherton and Hillsborough.

- To differentiate between starter homes and properties with larger square footage and lot size, the graph below includes the four quartiles of sold homes. The second quartile, representing sold homes with an average 1,935 square feet and lot sizes over 17K square feet, the median sale price has exceeded $2.25M.

- Low inventory further fueled the instance of multiple offers thus increasing the average percentage over asking price from 2020’s 2% to 10%.

- For condos and townhomes, the numbers also show positive growth of nearly 7.5%. The median sales price rose from $820K to $880K. More significantly, the number of months to sell dropped by half from 1.4 months to 0.7 months. Low inventory pushed sales over asking prices from 99% (accepted offers below asking) to 103%.

My Perspectives & Predictions

- Development within Santa Clara County. With legislation lifting restrictions on new housing units (SB 8, SB 9, SB 10), there’s more room for expanded housing production. SB 8 extends the Housing Crisis Act of 2019 to jumpstart more housing construction and SB 9 gives homeowners additional ways to add new housing. SB 10 allows for streamlined city zoning processes for multi-unit housing. There are also multiple large-scale commercial development projects in the works. Most notable is a Google campus in San Jose. There are mixed use projects on the table in San Jose, such as the El Paseo de Saratoga redevelopment. Homes situated in nearby neighborhoods that offer shorter commutes and proximity to “urban villages” become desirable.

- Mortgage interest rates, while historically low, are already rising. With every increase in mortgage rates, would-be home buyers lose buying power. The entry level buyers are directly impacted as rates increase. Ultimately these first-time buyers will be pushed out of the market, remain renters, and bolster the already inventory-constricted rental market. On a very positive note, the average jumbo loan was just 3.44% according to a recent Bankrate survey. That’s atypically well below the 3.71% average for conforming mortgages which is great news for borrowers who secure winning bids or for existing homeowners looking to refinance at lower rates.

- Home prices are expected to continue rising. 2021 saw amazing appreciation, with many zip codes seeing double-digit growth.The demand from buyers is unprecedented as is the opportunity for sellers who want to leave the area. 2022 started with all-time low inventory levels. You’ve heard this before but let me put this into perspective: it’s the lowest since we started keeping track of this statistic. Ever. There’s a literal log-jam in the market as sellers are reluctant to sell because there’s no inventory available for them to buy. Therefore, the traditional move-up buyer is stuck in place and that segment of inventory is not available as it typically should be.

- Stock market volatility, inflation and consumer confidence. Generally, the stock market performance, especially the NASDAQ, affects Bay Area wealth. Often new home buyers rely on cashing out stock options, leveraging RSU’s, or diversifying investment assets into down payments. So far this year Wall Street has reminded us riding the market can be a wild ride. Inflation continues to be an economic concern, pushing the purchase of big-ticket items before prices go up further. The national consumer confidence index dropped slightly from December’s 115.2 to January’s 113.8, yet still shows an overall positive outlook for business and consumer spending. I suspect 2022 will continue to see ups and downs as we work through supply-chain shortages and other national and global challenges caused by Covid.

- Finding a new normal with living with Covid. It appears that the latest Omicron wave has peaked even though we’re working through its aftermath. Flexibility about deciding when to bring workers back into the office is still in flux. That flexibility has translated into a desire for homes that have flexible spaces for remote work and schooling.

Reach Out & Connect

I’m meeting with clients via phone, video conferencing, and by appointment. Whether you’re looking to buy or sell, you need an experienced guide in this complex and fast-paced real estate market. I’ve helped hundreds of individuals like you successfully negotiate the most important financial transaction you’ll ever make.